how are rsus taxed when sold

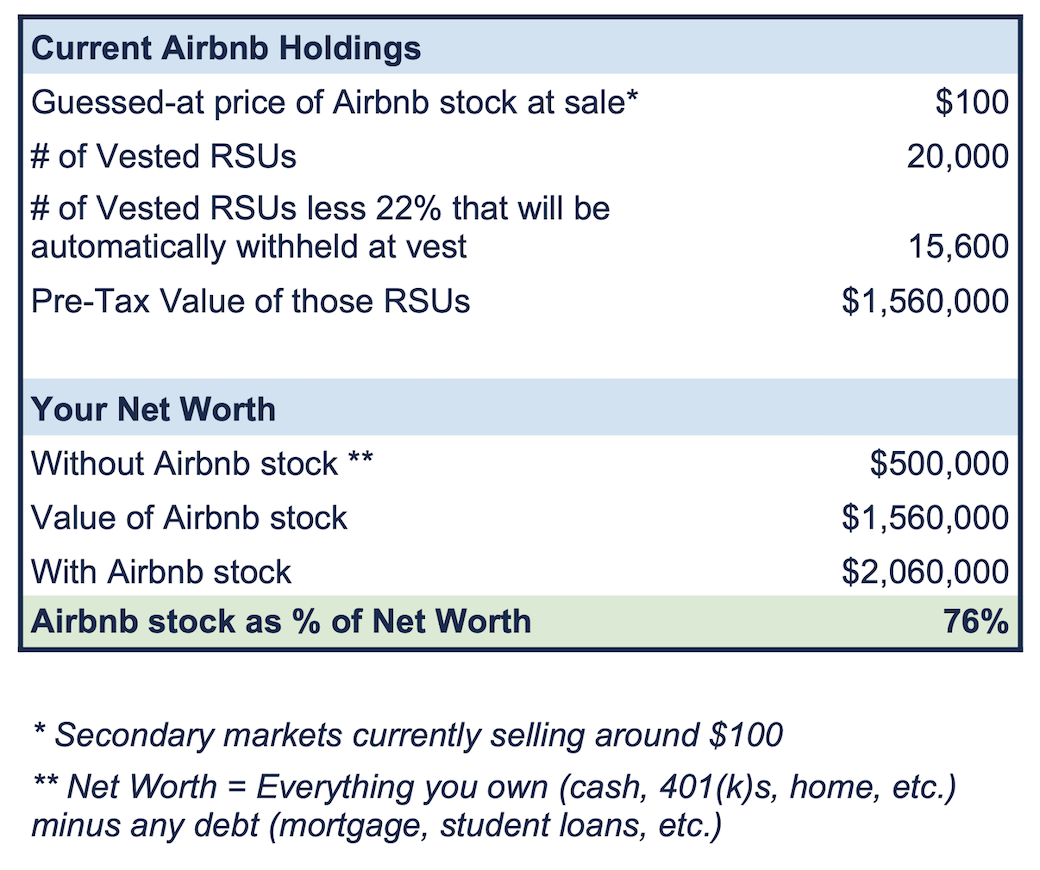

Partner Tax t. If we assume that the value will be settled in shares after a 22 statutory withholding well assume there are no other taxes.

Tax Basis And Stock Based Compensation Don T Get Taxed Twice

The total of all four years is 432000.

. For one a recipient cannot sell or. So unless your income including salary bonuses and. One way to reduce how much tax you pay on RSUs is by making pension contributions.

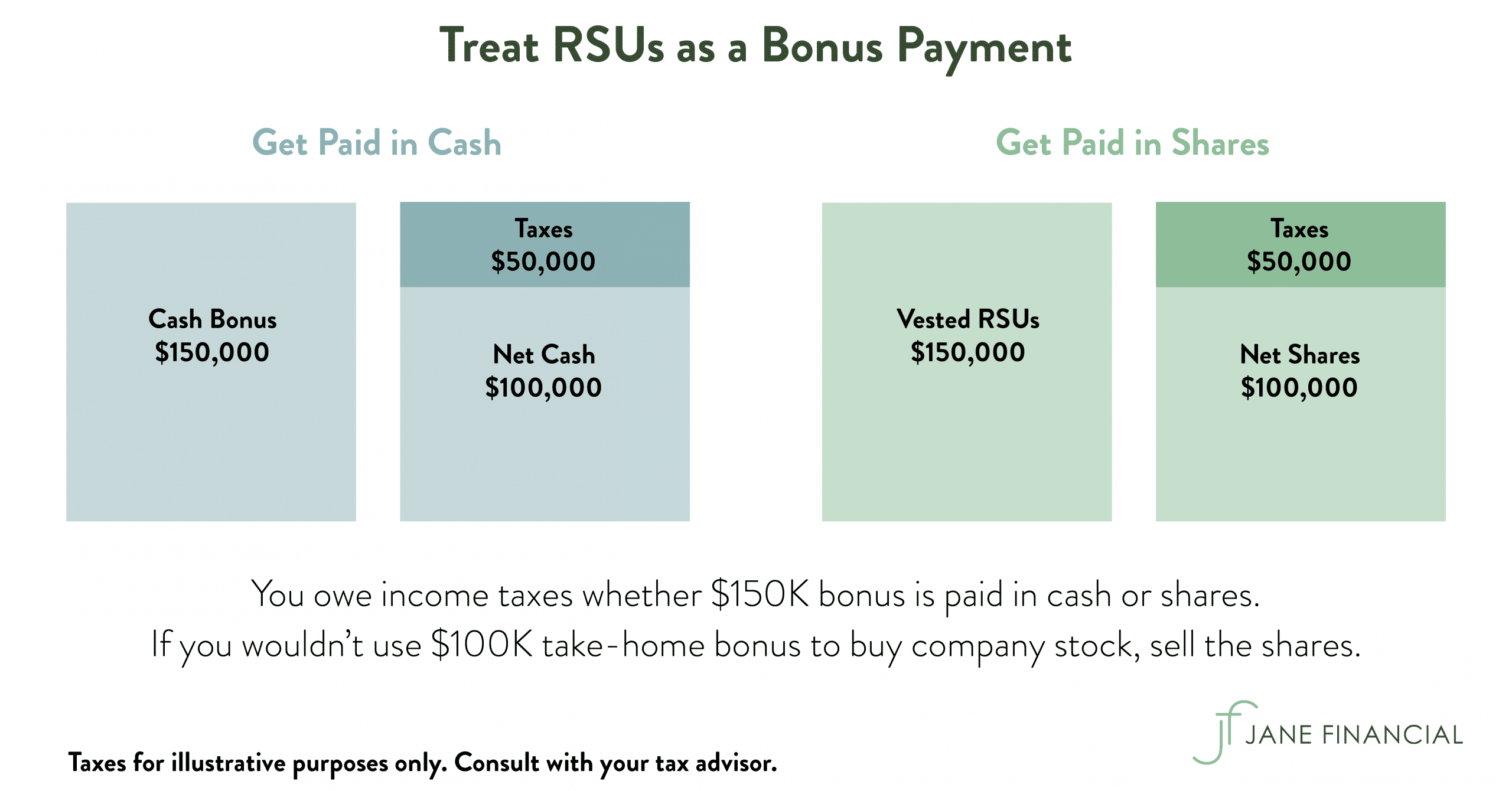

This is because paying into a pension reduces your adjusted. The difference between how your RSUs are taxed when they are received and later sold can create some confusion and common mistakes when it comes to RSUs and your. Just as with a cash bonus RSUs are taxed as ordinary.

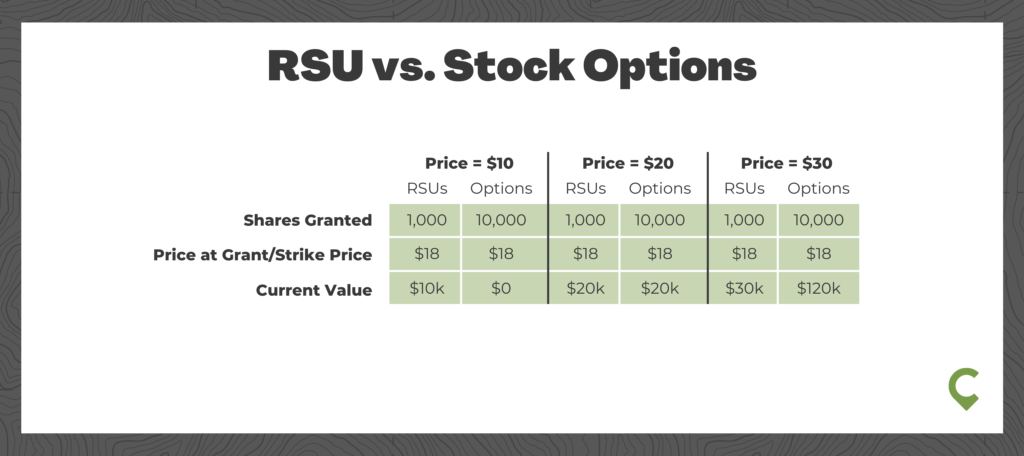

Taxes When You Sell RSUs. As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in.

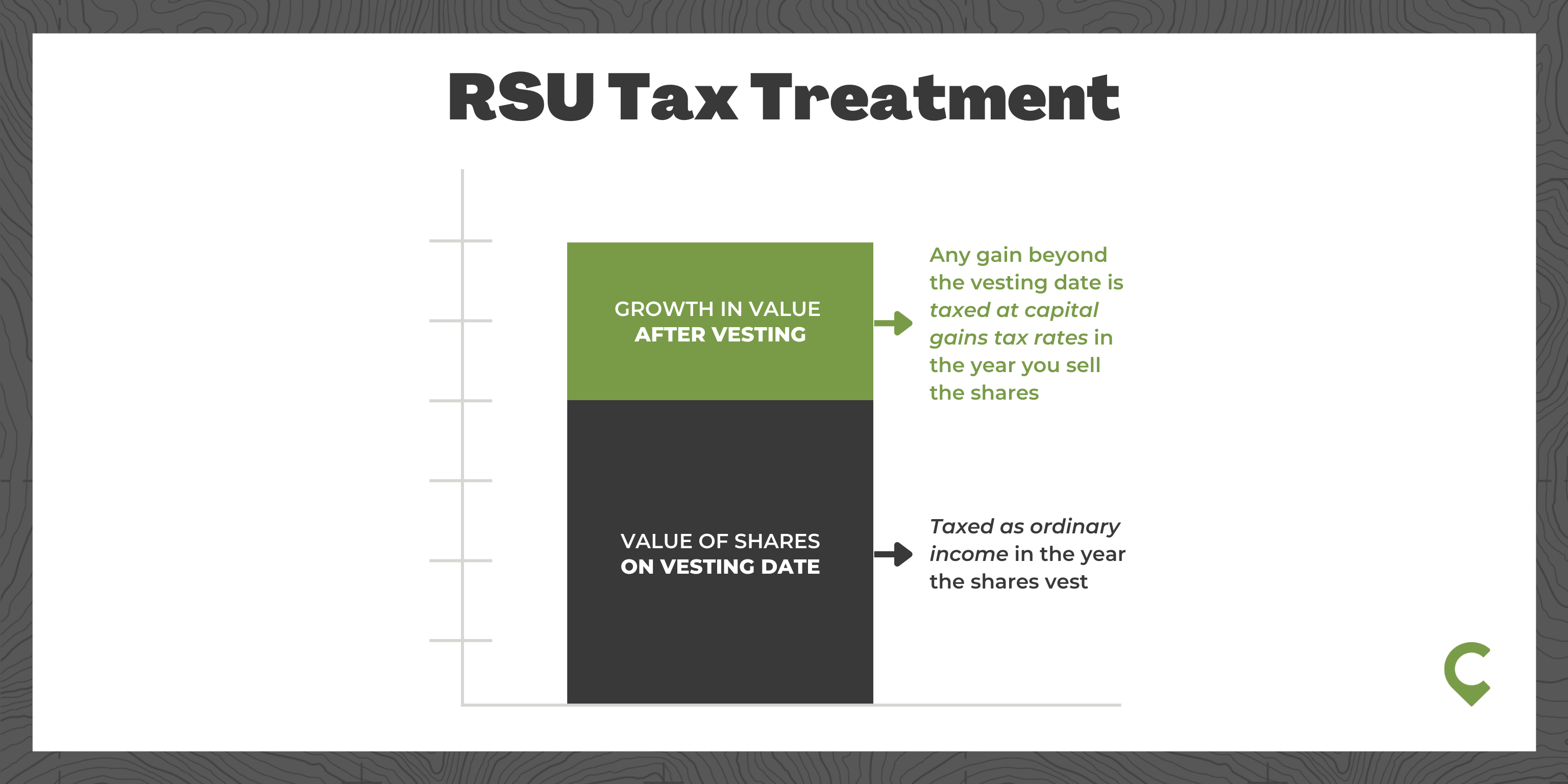

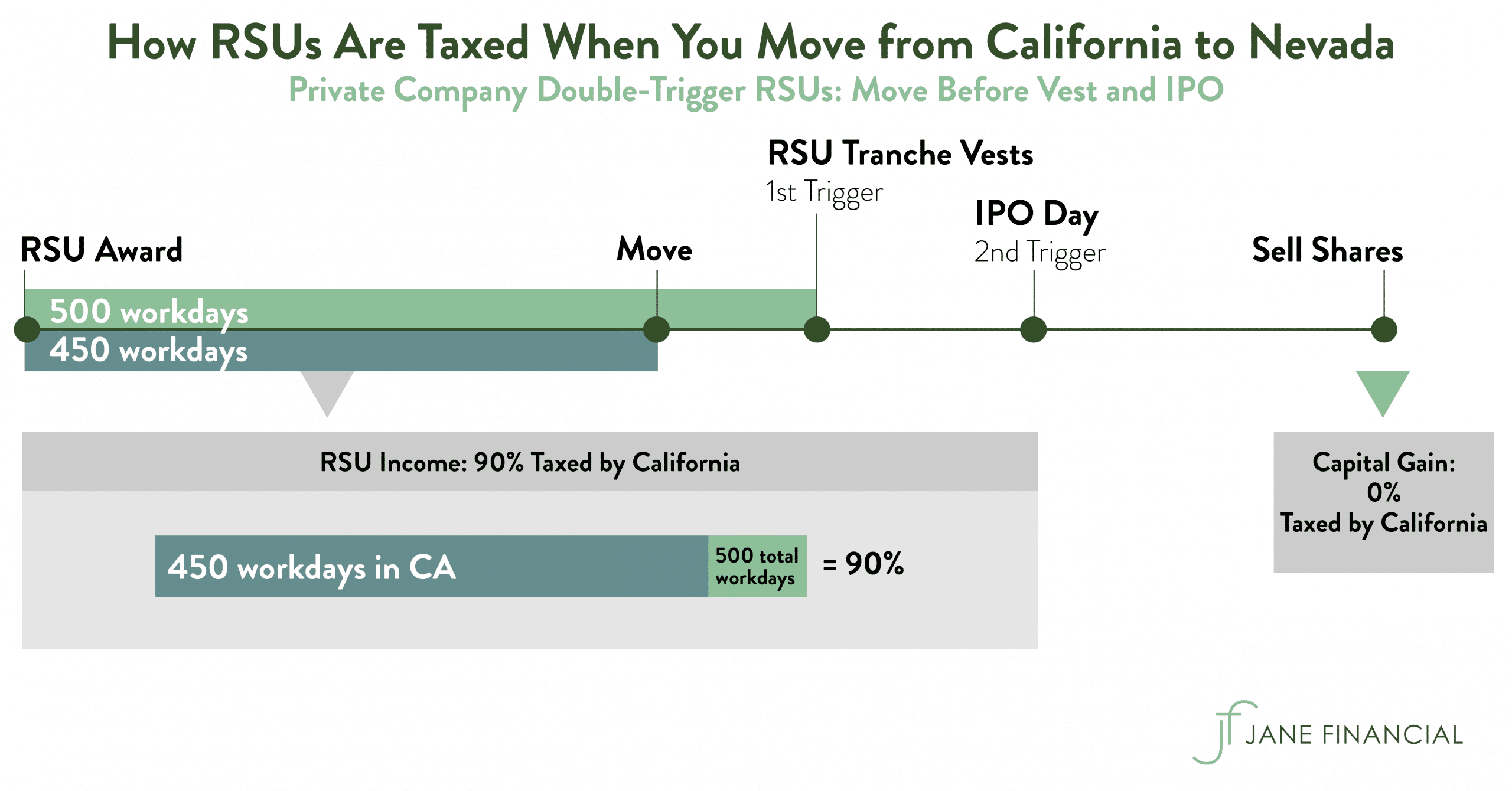

The only time capital gains tax comes into play is when the recipient of the RSUs choose to not sell the stock immediately and it appreciates in value before selling it. How are RSUs taxed. Each increment is subject to tax on the vesting date as compensation income when the shares are delivered.

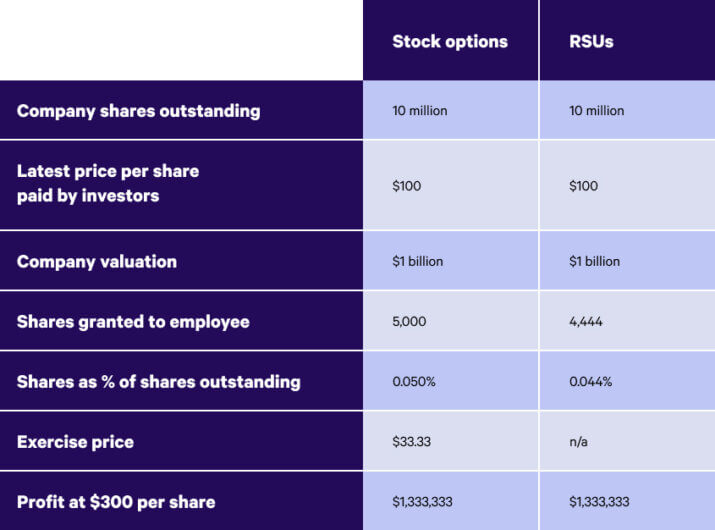

This rate is 238 20 plus the 38 tax on net investment. The problem is that RSUs are taxed as ordinary income. When RSUs are issued to an employee or executive they are subject to ordinary income tax.

Social Security Tax - 62 up to. Federal Income Tax - Varies based on income. You can choose to sell.

Restricted stock is a stock typically given to an executive of a company. The chart above shows that the employee sold some of the shares each year to pay taxes. Capital gains tax only applies if the recipient of RSUs does not sell the stock.

With RSUs if 300 shares vest at 10 a share selling yields 3000. RSU tax at vesting date is. The stock is restricted because it is subject to certain conditions.

The of shares vesting x price of shares Income taxed in the current year. The amount will be based on. Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees.

There is a separate capital gains tax that youll owe when you actually sell the stock award too assuming you sell at a gain. 44 020 7309 3851. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

The four taxes youll owe when you receive a paycheck or when an RSU vests include. With an all-in tax rate of 15 you only need to. FMV of Stock.

How can I reduce tax on RSUs. If held beyond the vesting date the RSU tax when shares. That is they will be taxed at your income tax bracket.

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsus A Tech Employee S Guide To Restricted Stock Units

Why Rsus Are Edging Out Restricted Stock Cfo

Airbnb Is Going Public What Should I Do With My Rsus Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

What You Need To Know About Restricted Stock Units Rsus

Rsu Taxes Explained 4 Tax Strategies For 2022

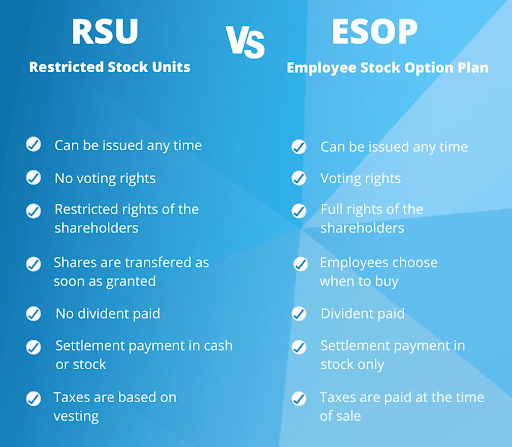

Rsus Vs Stock Options What S The Difference Wealthfront

Are Rsus Taxed Twice Rent The Mortgage

Stock Based Compensation Back To Basics

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

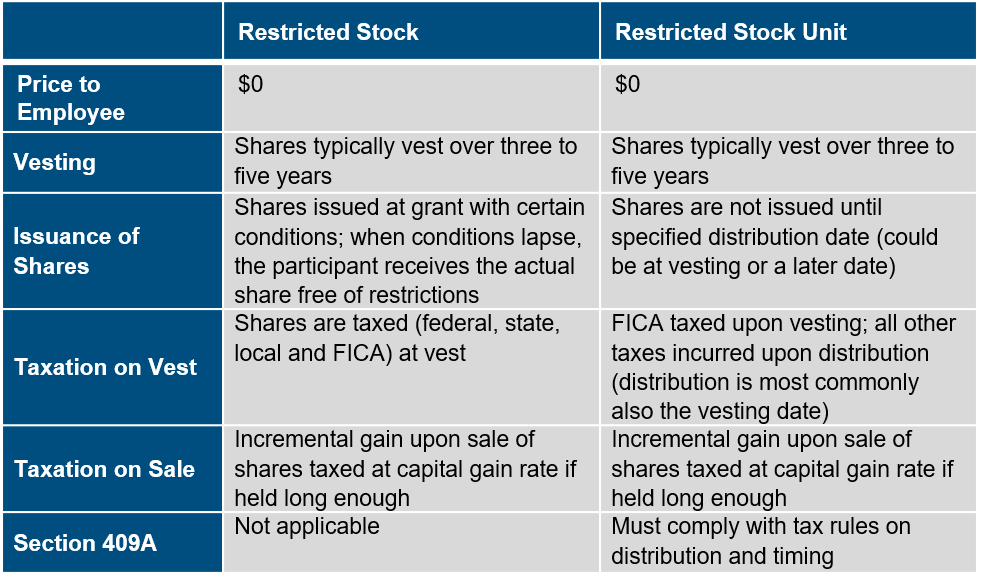

Transitioning From Stock Options To Rsus Pearl Meyer